How a leading Argentina’s crypto app uses Kleros Court to boost credibility

In Argentina, where inflation eats savings alive and crypto is a lifeline for millions, Lemon, a leading exchange with 4+ million users in LATAM, faced a problem. Users were losing money to hacks, phishing, or contested transactions, but Lemon’s internal team couldn’t resolve these conflicts fairly without becoming the “centralized authority” they promised to avoid. So they did what any crypto-native org would: they handed the issue to Kleros, a decentralized arbitration service for the disputes of the new economy.

The Lemon problem: Trust in a trustless system

Argentina’s economy is a case study in crypto adoption. With inflation at 100%+ annually, Lemon’s users rely on crypto for daily transactions. But when disputes happen, like a user claiming their wallet was hacked or funds stolen, Lemon hit a wall. Centralized arbitration felt like a betrayal of crypto’s ethos. Traditional legal systems? Too slow, too corrupt, and too expensive.Example: A user in Buenos Aires reported unauthorized access to their Lemon wallet. The exchange’s team couldn’t verify the claim without a paper trail. Escalating to a real-world court would take months and cost more than the disputed funds. Worse, Argentina’s judiciary is notorious for inefficiency: 80% of commercial disputes linger unresolved for over a year (World Bank, 2024). Lemon risked becoming the very institution crypto aimed to disrupt.

The Kleros solution: Decentralized arbitration for crypto disputes

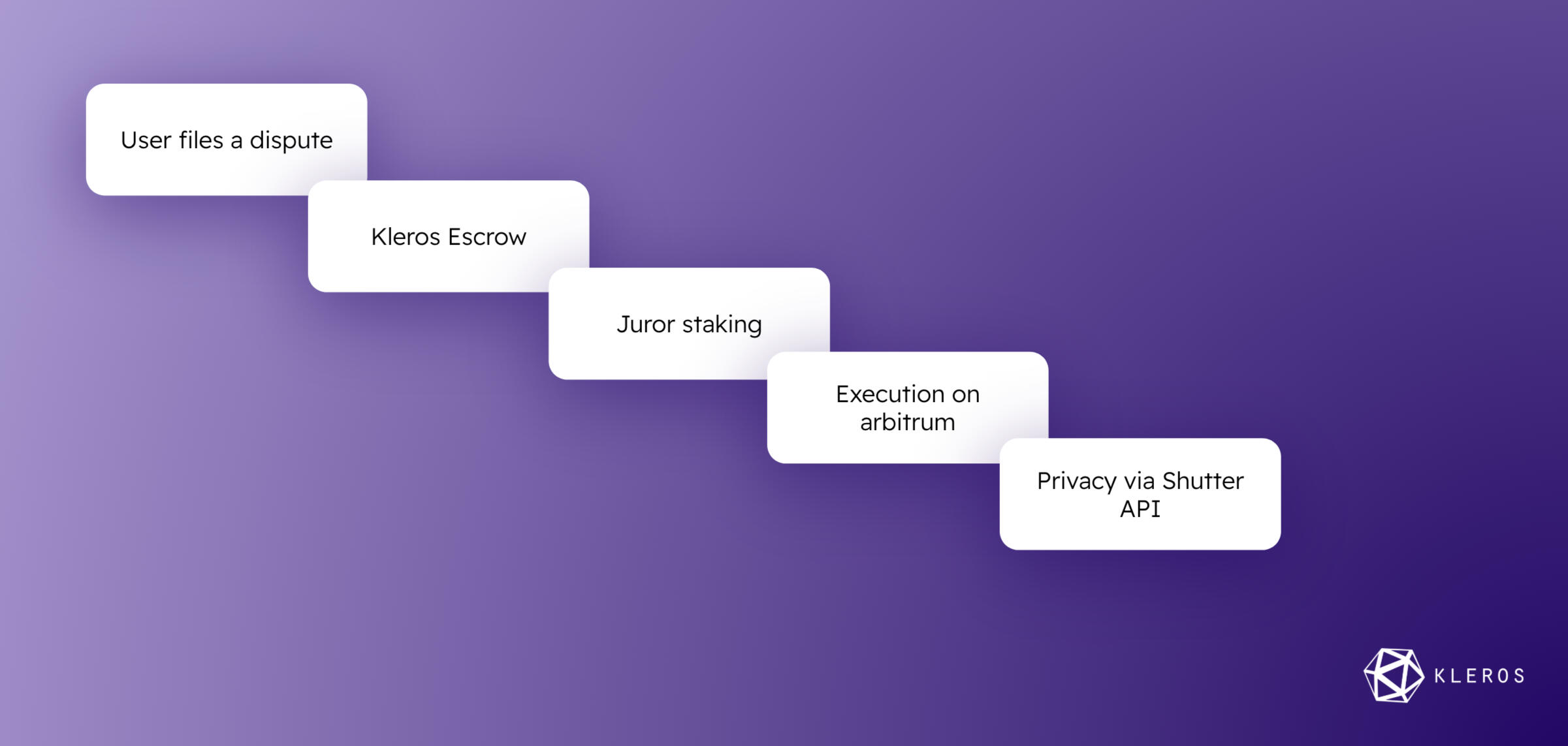

In 2024, Lemon integrated Kleros’s dispute resolution protocol. Here’s how it works:

User files a dispute: A Lemon customer claims their wallet was compromised or a transaction was contested.

Kleros Escrow: Lemon locks the disputed funds in a smart contract. Users pay a small fee (e.g., $10 in ETH/DAI) to escalate the case to Kleros.

Juror staking: Kleros randomly selects jurors who stake PNK tokens. If they vote dishonestly, they lose their stake. If honest, they earn rewards from the dispute fees and 4. Kleros’ inflationary tokenomics.

Execution on arbitrum: Rulings are enforced via Arbitrum One, slashing gas fees to ~$0.10. For users earning pesos, this is critical: even $1 in gas fees can represent 10% of a day’s wages.

Privacy via Shutter API: Jurors vote anonymously until the ruling is finalized, preventing collusion. In Argentina, where organized crime sometimes pressures judges, this anonymity ensures rulings aren’t influenced by threats.

Real Case: A Lemon user claimed their wallet was drained by a phishing attack. Kleros jurors reviewed transaction hashes, wallet logs, and phishing evidence. The majority voted that the user was at fault (they clicked a malicious link). Funds were released to the seller automatically.

Lemon doesn’t play judge. Kleros’s decentralized jurors do, with 90% customer retention even for users who lose their case. Why? The process is transparent and auditable. Losing parties can’t blame “corrupt corporate interests”. They see cryptographic evidence and voting records.

Decentralized justice isn’t just for NFTs: Lemon’s integration proves Kleros isn’t just a niche tool for DeFi or NFT royalty fights. It’s a practical fix for crypto exchanges where trust and speed collide. For Argentina’s users, it’s a way to get justice without leaving their home or their crypto principles.

Interested in integrating Kleros? Reach out!